About The Project

The Financial Data Revolution:

Seizing the Benefits, Controlling the Risks

The Significance

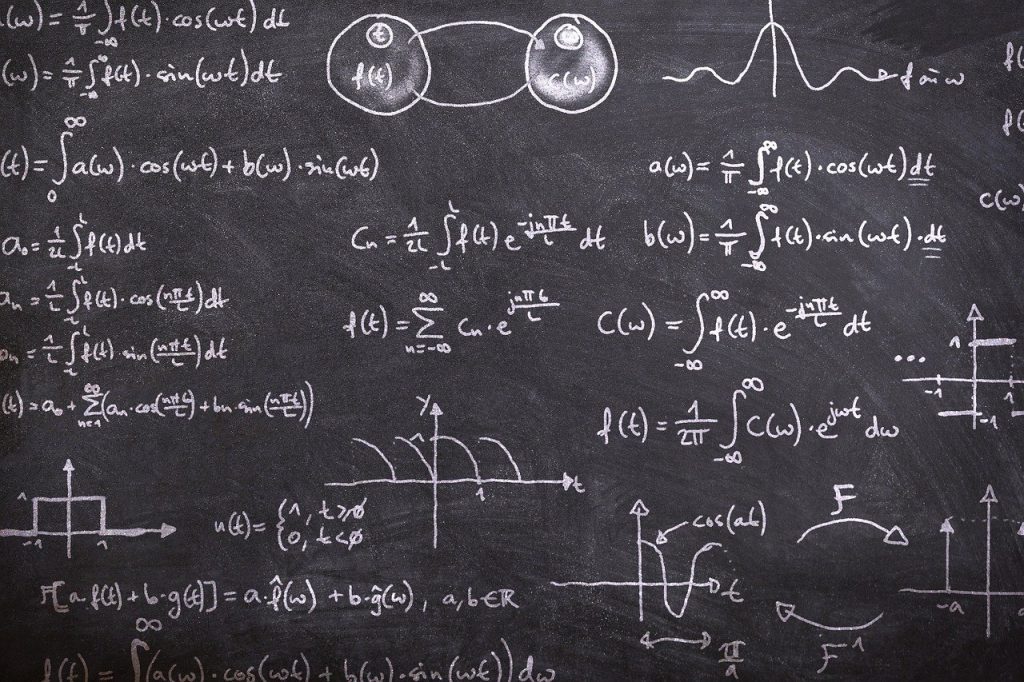

A data revolution is underway. We live amid the biggest commercial and social transformation since the Industrial Revolution: driven by the increase in volume of data; and advances in its algorithmic analysis. In 2018, 33 zetabytes (33 trillion gigabytes) of data was created, predicted to rise to 175 zetabytes (175 trillion) by 2025.[1] By July 2021, the new Consolidated Audit Trail initiative of the US Securities and Exchange Commission expects, once operational, to be processing 58 billion financial transaction records every day.[2]

Data

Data can be used: (i) by providers to offer better financial services, (ii) by regulators to promote systemic stability and prevent abuses, and (iii) by consumers to receive better and more competitive services. This Laureate research project will analyse each of these uses of data in the context of finance.

On the upside, data and technology are revolutionising financial services so that they can be extended more broadly: improving lives, lifting economic growth and reducing poverty. In Australia the financial system serves small businesses and consumers poorly — in ways in which those of us with home loans are usually unaware. For instance, between April 2016 and July 2019, Australians borrowed over 4.7 million payday loans of up to $2,000 at 68% p.a.[3] Our financial system today keeps poor people poor. The answer to this real financial hardship is technology — using algorithmically interpreted data to (i) accurately price risk, and thus credit, for these people (an example of FinTech), and (ii) to monitor the behaviour of those selling them the credit (an example of RegTech).

FinTech and RegTech

FinTech is software that deals innovatively with data to solve problems in financial services. US$478.4 billion was invested in it globally from 2017 to 2020.[4] It includes robo-advice, peer-to-peer lending, crowd-funding, payments applications and new risk management methods.[5] RegTech is software that deals innovatively with data to help firms meet their compliance obligations or to help regulators regulate. It is currently enabling cheaper financial services by reducing the regulatory compliance costs of banks, features in bank responses to the abuses identified by the Hayne Royal Commission in Australia,[6] and in time will underpin all financial supervision by regulators.

The Risks

This data revolution comes with many, as yet uncontrolled, risks. These relate to inaccurate data and its poor algorithmic analysis or other misuse, and are facilitated by poor regulation.[7] These risks are global, none are uniquely Australian, and most are regularly ignored amid the hype. High profile FinTech risks to manifest here have been the long-running robo-debt scandal[8] and Westpac’s 23 million breaches of anti-money laundering laws.[9]

The implementation of the Consumer Data Right (CDR) progressively from 2020 will bring many more such risks as data that has previously been housed safely in one bank will suddenly be able to be moved between providers. Furthermore, FinTech can promote opacity and complexity, thus reinstating some causes of the 2008 GFC.[10] RegTech, poorly applied, could mask an upcoming crisis. Peer-to-peer lending can generate destabilizing sub-prime loans as seen in China,[11] and central bank digital currencies could readily facilitate the collapse of a banking system through the mother of all bank runs.[12]

More generally, we need to learn how to regulate algorithms so they produce transparent and ethical outcomes, otherwise the damage to consumers will be massive.[13] Doing so will also inform global responses to data risks beyond its use in finance and regulation, such as in judicial sentencing[14] and healthcare.[15]

The Laws

As technological change accelerates, law struggles to respond, everywhere. This project will support the legal recrafting needed to allow realisation of the many benefits and curbing of the many severe risks of this data revolution in finance and regulation. Australia provides a highly suitable laboratory for this research, and the act of solving pressing regulatory problems in one legal system will generate learnings of relevance internationally.

Today’s laws are designed to deal mostly with “things”, tangible things, capable of being possessed and which, if sold, no longer belong to the seller. Data differs from things. You can transfer data about you to another and still possess it; or your bank can share data about you with another bank and all three entities have rights over it. Just as agriculture requires water, this data-driven transformation requires laws to protect and facilitate the use of data, and limit its misuse. Current, poorly adapted, laws often produce lose-lose outcomes – both thwarting innovation and not protecting consumers from the misuse of data about them. Regulation of innovative enterprises retards their growth as it quickly applies the onerous regulatory requirements that only the major banks can readily afford. Laws reduce cybersecurity in myriad ways by not being adapted to a data-driven world. Statutory requirements prevent functions of meetings being discharged by smart contracts and recorded on blockchains, and result in software solutions using work-arounds to accommodate ill-suited laws. Our tick-the-box consent model for data is a contractual approach suited to the sale of things – if you don’t like one apple buy another – but hopelessly adapted to a world with effectively only one social media platform, one major software provider and one search engine, and in which only 6% of people read privacy statements.[16]

The Project's Aim

In short, while FinTech has great potential, current laws everywhere stifle its growth and fail to deal well with the attendant major risks. This knowledge gap is global. The major difference between progressive regulators, and those less adept, is that the former acknowledge they don’t know how to properly regulate the use of data and how it underpins FinTech and RegTech.[17] This project sets out to assist law makers and regulators with the daunting challenges posed by the Data Revolution.

[1] David Reinsel, John Gantz, John Rydning, The Digitization of the World: From Edge to Core (International Data Corporation White Paper No US44413318, November 2018) 6 <https://www.seagate.com/files/www-content/our-story/trends/files/idc-seagate-dataage-whitepaper.pdf>.

[2] ‘CAT NMS Selects FINRA as Consolidated Audit Trail Plan Processor’, Consolidated Audit Trail (online, 27 February 2019) <https://www.catnmsplan.com/announcements/cat-nms-selects-finra-consolidated-audit-trail-plan-processor>.

[3] Stop the Debt Trap Alliance, The Debt Trap: How Payday Lending is Costing Australians (Report, 12 November 2019) 4, 7 <https://consumeraction.org.au/20191112-the-debt-trap-report/>.

[4] KPMG, The Pulse of Fintech H2’20 (Report, February 2021) 8 <https://assets.kpmg/content/dam/kpmg/xx/pdf/2021/02/pulse-of-fintech-h2-2020.pdf>.

[5] Patrick Schueffel, ‘Taming the Beast: A Scientific Definition of Fintech’ (2016) 4(4) Journal of Innovation Management 32, 32–3.

[6] Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry (Final Report, February 2019) vol 1, 2.

[7] Douglas W Arner, Jànos Barberis and Ross P Buckley, ‘The Emergence of RegTech 2.0: From Know Your Customer to Know Your Data’ (2016) 44 Journal of Financial Transformation 79.

[8] Valerie Braithwaite, ‘Beyond the Bubble That is Robodebt: How Governments That Lose Integrity Threaten Democracy’ (2020) 55(3) Australian Journal of Social Issues 242, 243–246. Denham Sadler, ‘‘ServicesAus’ Tech Systems Made Robodebt Worse’, Innovation Aus (online, 8 April 2021) <https://www.innovationaus.com/servicesaus-tech-systems-made-robodebt-worse/>; Luke Henriques-Gomes, ‘Billion-dollar Robodebt Settlement Reveals Massive Scale of Welfare Crackdown Disaster’, The Guardian (online, 17 November 2020) <https://www.theguardian.com/australia-news/2020/nov/17/billion-dollar-robodebt-settlement-reveals-massive-scale-of-welfare-crackdown-disaster>.

[9] Ian Fargher, ‘How Westpac is Alleged to Have Broken Anti-money Laundering Laws 23 Million Times’, The Conversation (online, 25 November 2019) <https://theconversation.com/how-westpac-is-alleged-to-have-broken-anti-money-laundering-laws-23-million-times-127518>; James Frost, ‘Westpac admits 23m anti-money laundering breaches’, Financial Review (online, 15 May 2020) <https://www.afr.com/companies/financial-services/westpac-admits-23m-anti-moneylaundering-breaches-20200515-p54ta9>.

[10] Ross Buckley and Douglas W Arner, From Crisis To Crisis: The Global Financial System and Regulatory Failure (Kluwer Law International, 2011).

[11] Frank Tang, ‘Is China ripe for a subprime crisis? Regulator sees bank property loans as ‘biggest grey rhino risk’ for financial system’, South China Morning Post (online, 1 December 2020) <https://www.scmp.com/economy/china-economy/article/3112114/china-ripe-subprime-crisis-banking-regulator-sees-property>.

[12] Anton N Didenko and Ross P Buckley, ‘The Evolution of Currency: From Cash to Cryptos to Sovereign Digital Currencies’ (2019) 42(4) Fordham International Law Journal 1041, 1091.

[13] Rod Sims, ‘The ACCC’s Approach to Colluding Robots’ (Speech, Australian Consumer and Competition Commission, 16 November 2017) <https://www.accc.gov.au/speech/the-accc%E2%80%99s-approach-to-colluding-robots>.

[14] Nigel Stobbs, Dan Hunter and Mirko Bagaric, ‘Can Sentencing Be Enhanced by the Use of Artificial Intelligence?’ (2017) 41 Criminal Law Journal 261, 261–2.

[15] Ran D Balicer and Chandra Cohen-Stavi, ‘Advancing Healthcare Through Data-Driven Medicine and Artificial Intelligence’ in Bernard Nordlinger, Cédric Villani and Daniela Rus (eds), Healthcare and Artificial Intelligence (Springer, 2019) 9.

[16] Consumer Policy Research Centre, CPRC 2020 Data and Technology Consumer Survey (Report, 7 December 2020) 18 <https://cprc.org.au/publications/cprc-2020-data-and-technology-consumer-survey/>.

[17] Douglas W Arner, Jànos Barberis and Ross P Buckley, ‘FinTech, RegTech, and the Reconceptualization of Financial Regulation’ (2017) 37(3) Northwestern Journal of International Law & Business 371, 398–99. Leon Perlman, ‘Fintech and Regtech: Data as the New Regulatory Honeypot’ (Paper, Digital Financial Services Observatory, Columbia Business School, 2 December 2019) 28 <https://dfsobservatory.com/publication/fintech-and-regtech-data-new-regulatory-honeypot>.